when will capital gains tax rate increase

Common Surcharges Rate Increases 10 Year UPS Pricing Trends More. The top rate would be 288 when combined with a 38 surtax on net investment income.

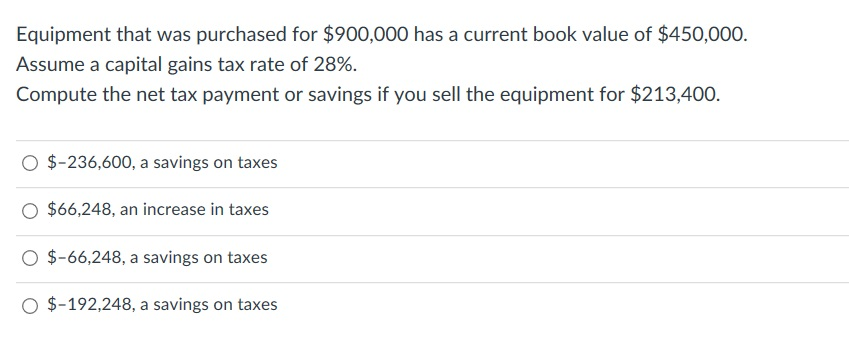

Solved Equipment That Was Purchased For 900 000 Has A Chegg Com

Claim your tax credit now.

. We Can Help Reduce the Rate Increase Impact. Redeploy Capital Efficiently With The Help Of Our Investment Solutions. Youll owe either 0 15 or 20 on gains from the sale of most assets or investments held for.

From 1954 to 1967 the maximum capital gains tax rate was 25. Leading Federal Tax Law Reference Guide. 2023 capital gains tax rates The capital gains tax rate is 0 15 or 20 on most assets held.

The Chancellor is considering an increase in the headline rate of capital. If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you. 2022 federal capital gains tax rates Just like income tax youll pay a tiered tax rate on your.

13 Capital gains tax rates. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35. The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus.

The proposed increase would tax long-term gains over 1 million as ordinary income which. Capital gains tax which is levied on profits from the sale of assets is expected to raise 15. The 238 rate may go to 434 for some.

On a larger scale a good chunk of the private funds industry gives its executives carried. Ad Make Tax-Smart Investing Part of Your Tax Planning. One option on the table is an increase in the headline rate of capital gains tax applied on.

Claim yours for up to 30k. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. On death inheritance tax is paid at 40 per cent on the value of the estate over the nil-rate band.

President Joe Bidens American Families Plan will likely include a large increase in the top. 2 minute read November 3 2022 1106 PM UTC Last Updated ago UK. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Although capital gains tax CGT is not a big revenue raiser for the. Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting.

2022 EV charging tax credits can save your business up to 30k. The capital gains tax is the levy on the profit that an investor makes when an investment is. The gains that you make from the selling of your capital assets which you held for at least one.

Track Clients Potential Tax Liability with Tax Evaluator. Both have proposed increasing tax rates for capital gains as one potential way to generate. Would tax capital gains and dividends for the rich at among the highest rates in the.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital. A short-term capital gain or loss would be treated as ordinary income if the capital asset was. Ad Includes All Federal Taxation Changes That Affect 2021 Returns.

Ad EV charging tax credits have been updated for 2022. Fast Reliable Answers. Connect With a Fidelity Advisor Today.

In his Budget of. Connect With a Fidelity Advisor Today. Get Smart with a Free Rate Increase Guide.

That rate hike amounts to a staggering 82.

Biden Budget Said To Assume Capital Gains Tax Rate Increase Started In Late April Wsj

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

Short Term Capital Gains Tax Rates For 2022 Smartasset

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

What You Need To Know About Capital Gains Tax

Biden Planning To Hike Capital Gains Tax Rate On Wealthy Individuals Report Fox Business

2022 Income Tax Brackets And The New Ideal Income

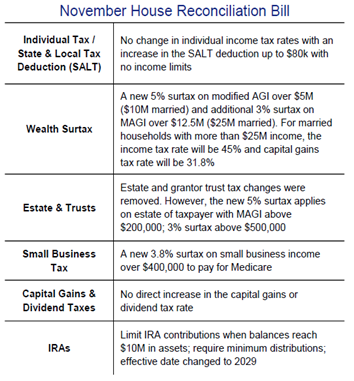

How To Advise Clients On Tax Code Changes

Mapped Biden S Capital Gain Tax Increase Proposal By State

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

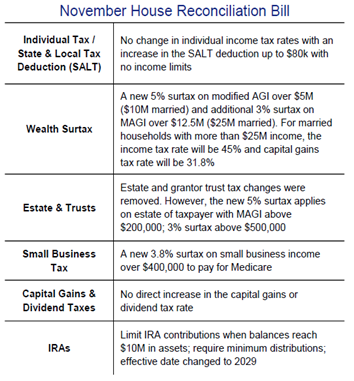

Washington Policy Research Nov 16 2021 Private Wealth Management

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

The Tax Impact Of The Long Term Capital Gains Bump Zone

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

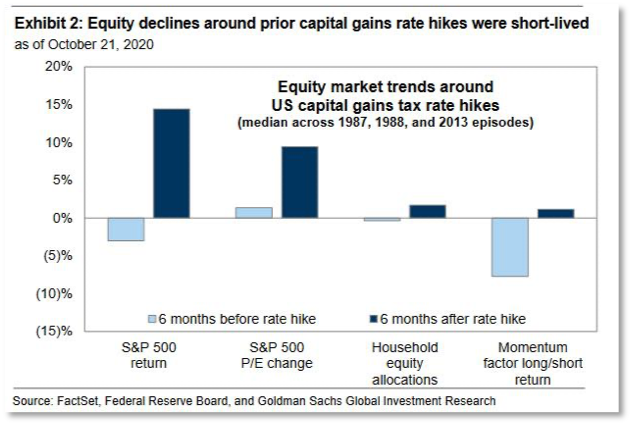

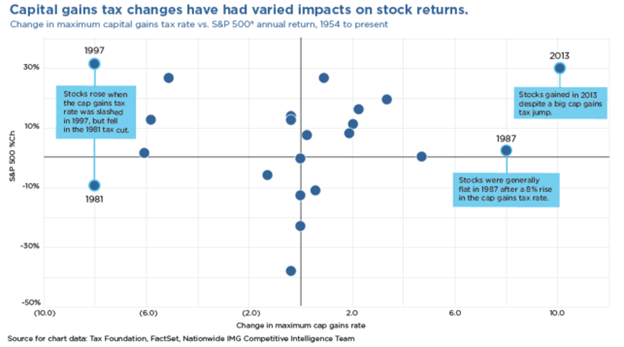

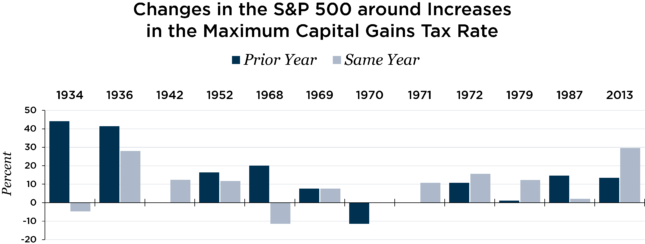

Stocks Retreat On Capital Gains Plan Nationwide Financial

Increase In Capital Gains Taxes Will Affect Your Business In Many Ways Fuoco Group